karen@mail.karencynowa.com

Blog

Is a Housing Market Crash Coming? Here’s What Experts Say

Why Prices Are Adjusting Right Now

Yes, in some local markets, home prices are flattening or dipping slightly this year. That’s a normal response to rising inventory—more homes on the market give buyers more options. But a little cooling is very different from a crash.

The big picture is what matters, and it’s far less dramatic than the doom-and-gloom headlines suggest.

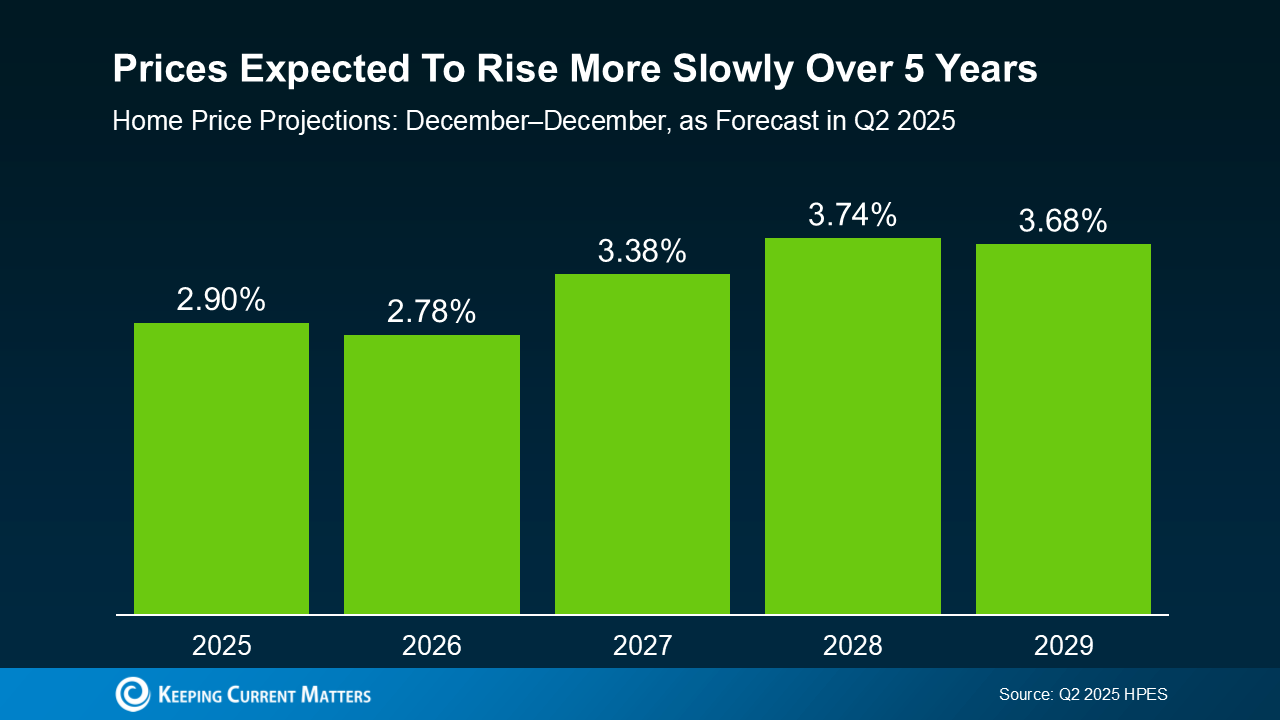

What Experts Project for the Next 5 Years

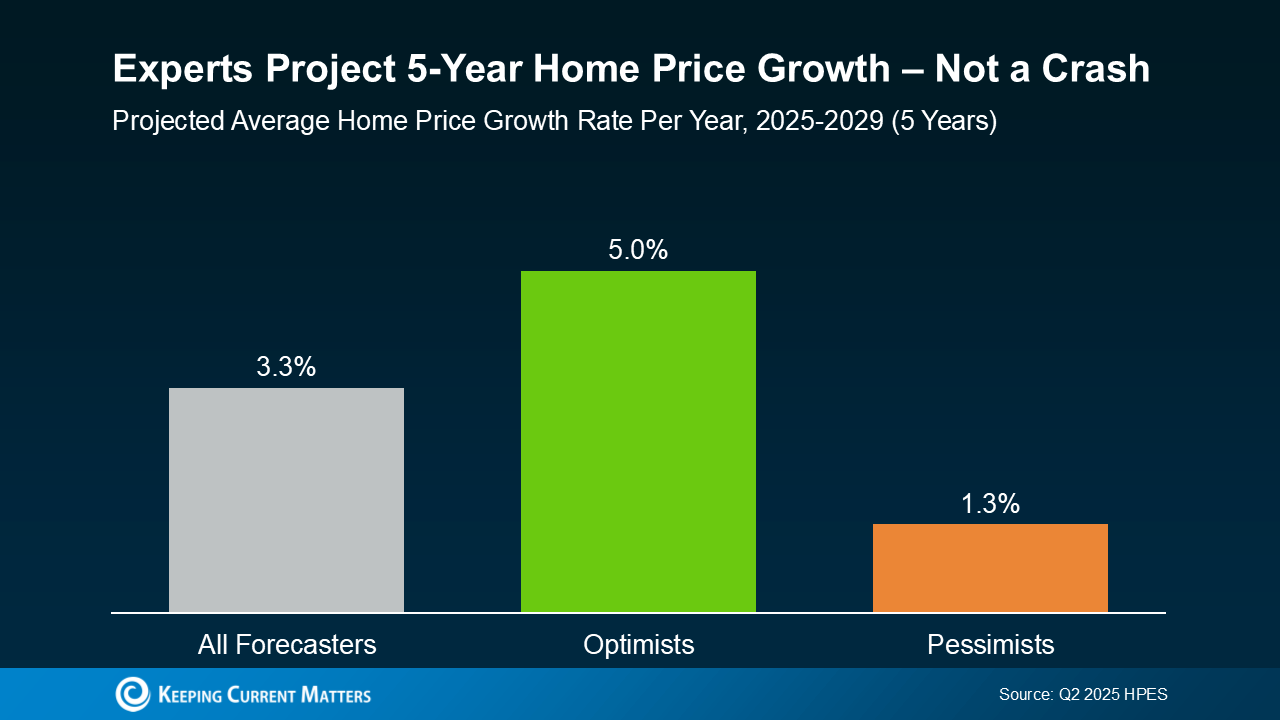

Every quarter, Fannie Mae conducts the Home Price Expectations Survey (HPES), which gathers insights from over 100 housing market experts. Here’s what they forecast:

Average projection: Home prices will grow by about 3.3% per year through 2029.

Optimists: See prices rising closer to 5% annually.

Pessimists: Still forecast growth of about 1.3% per year.

That’s the key takeaway: while the pace of growth is slowing down from the frenzy of the past few years, not one expert group is calling for a national decline or crash.

Why the Market Is Stable

Several factors are keeping the housing market on solid footing:

Low foreclosure rates – Homeowners aren’t being forced to sell.

Stronger lending standards – Buyers today are better qualified.

Near-record homeowner equity – Giving people financial stability.

These conditions make the kind of crash we saw in 2008 highly unlikely.

What This Means for Buyers and Sellers

Buyers: If you’re waiting for prices to fall significantly, you may be waiting a long time. Even conservative forecasts show steady appreciation.

Sellers: While you may not see bidding wars like in 2021, today’s buyers are motivated, and your home can still attract strong offers if priced right.

Bottom Line

The housing market isn’t crashing—it’s normalizing. Prices are expected to grow at a steady, more sustainable pace over the next five years.

If you want to understand what this means for your neighborhood (since real estate is always local), connect with a trusted real estate agent. National trends set the tone, but local market data tells the story that matters most to you.