karen@mail.karencynowa.com

Blog

Is Your House Secretly a Millionaire? (Here’s How to Find Out)

Here’s the scoop: your home isn’t just where you kick off your shoes and binge Netflix. It’s also (most likely) the biggest financial asset you own. And if you’ve been living in it for a few years, chances are it’s been quietly stacking up wealth for you in the background. Spoiler: it’s called equity—and you might have way more than you think.

What Exactly Is Home Equity?

Think of equity as the magic math behind your home’s value. It’s the difference between what your house is worth today and what you still owe on your mortgage.

Let’s say your home is worth $500,000 and you still owe $200,000 on your loan. Boom—you’ve got $300,000 in equity. That’s right in line with today’s average. In fact, according to CoreLogic, the typical homeowner with a mortgage has about $302,000 in equity.

Pretty wild, right? That’s like having a six-figure bank account without even realizing it.

Why You Probably Have More Than You Think

Two big reasons most homeowners are sitting on near-record levels of equity:

1. Home Prices Skyrocketed.

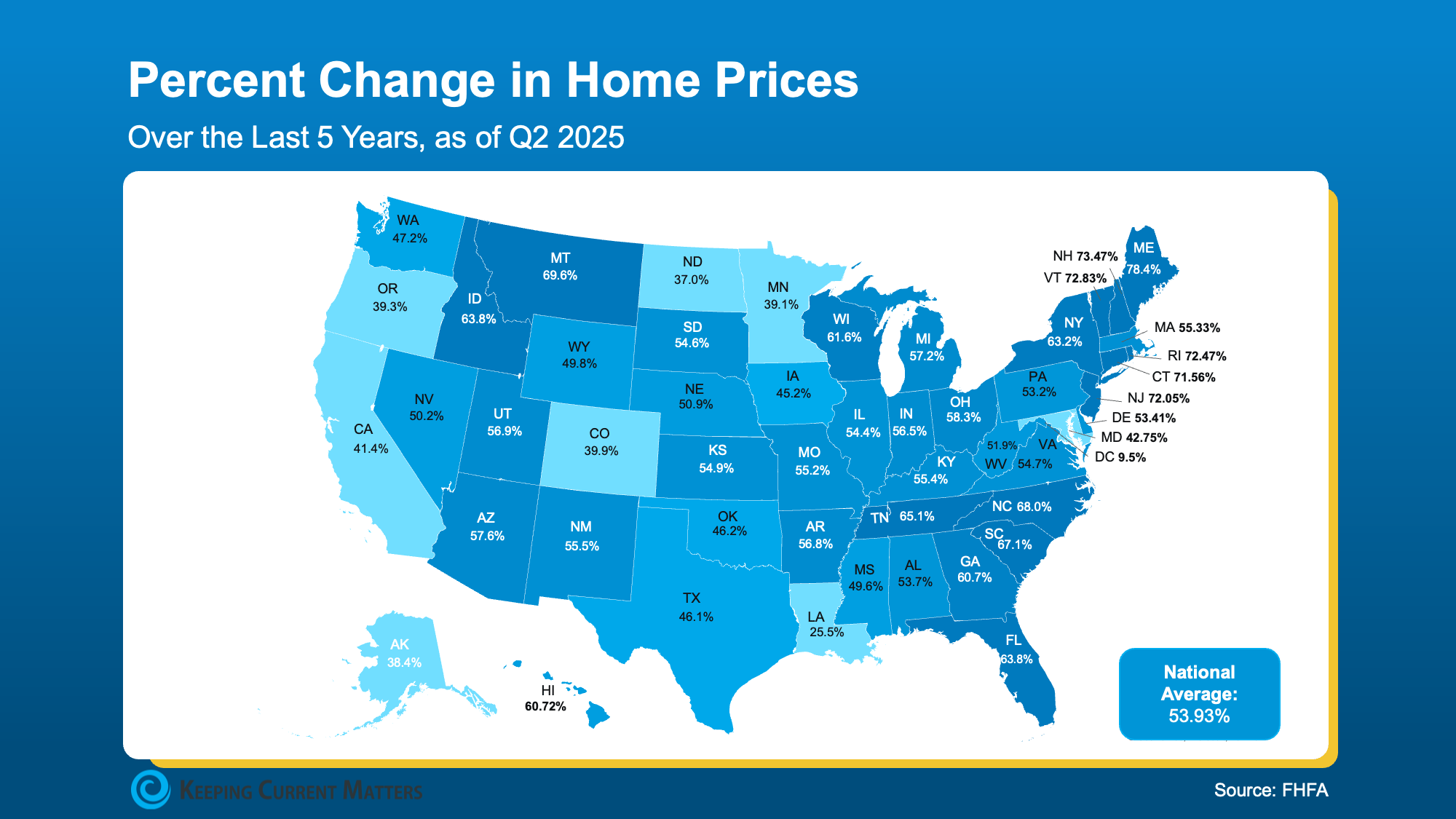

According to the Federal Housing Finance Agency (FHFA), home prices nationwide have shot up nearly 54% in just five years. That means even if prices have cooled a bit recently, if you’ve owned your home for a while, you’re still way ahead of the game.

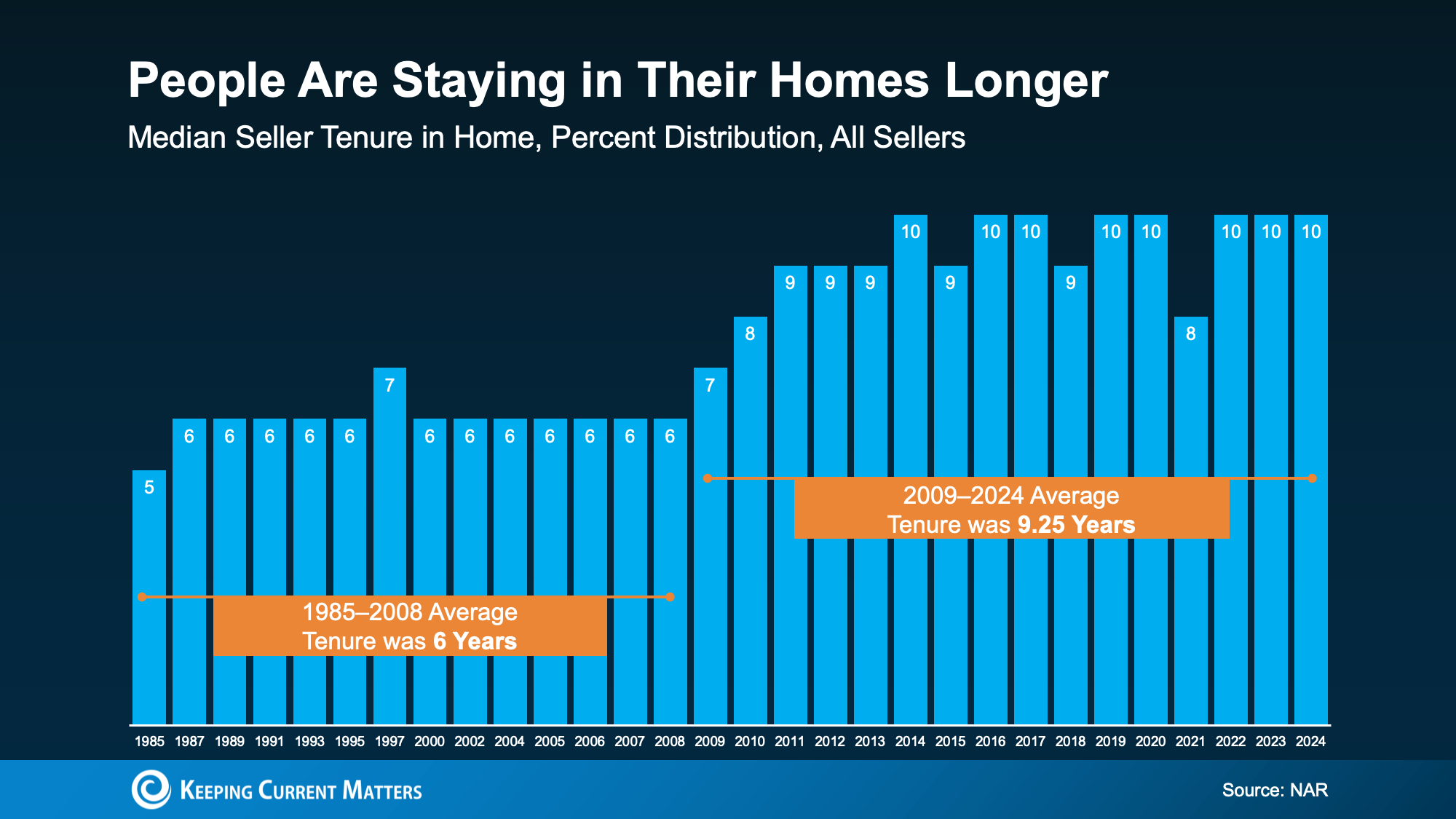

2. People Stay Put Longer.

Data from the National Association of Realtors (NAR) shows homeowners are hanging onto their houses for about 10 years on average. Over that time, you’ve been paying down your mortgage and riding the wave of rising home values. Translation: you’ve been winning the long game.

In fact, NAR says the typical homeowner has built up $201,600 in wealth over the last decade just from price appreciation alone. Not bad for simply paying your mortgage on time.

So… What Can You Do with All That Equity?

Here’s the fun part: equity isn’t just a boring number on paper. It’s a financial superpower you can actually use. Depending on your goals, you could:

✨ Level Up to Your Next Home. Use that equity for a down payment—or in some cases, even buy your next place with all cash.

✨ Renovate Your Current Space. Finally build that dream kitchen, extra bathroom, or backyard oasis. Bonus: smart updates can boost your home’s value even more.

✨ Kickstart a Business. Always dreamed of being your own boss? Your equity could fund those startup costs and give you the runway to grow.

Bottom Line

Your house may be worth way more than you think—and that hidden equity could open doors (literally). Whether you’re ready to upgrade, remodel, or chase a passion project, your home’s value could be the key.

Curious about how much equity you’re sitting on? Connect with a local agent who can run the numbers for you. Who knows—your house might just be your secret millionaire status.