karen@mail.karencynowa.com

Blog

Wait… Did Buying a Home Just Get Slightly Easier? (Yes, Really!)

Buying a home these past few years has been… well, let’s call it what it was: brutal. Prices soared. Mortgage rates climbed. And a lot of would-be buyers hit pause because the math just didn’t math.

But guess what? There’s finally a little sunshine peeking through those storm clouds. If you’ve been waiting for a better time to jump back in, this fall might just be your comeback season. Why? Because affordability is starting to show signs of life. 🙌

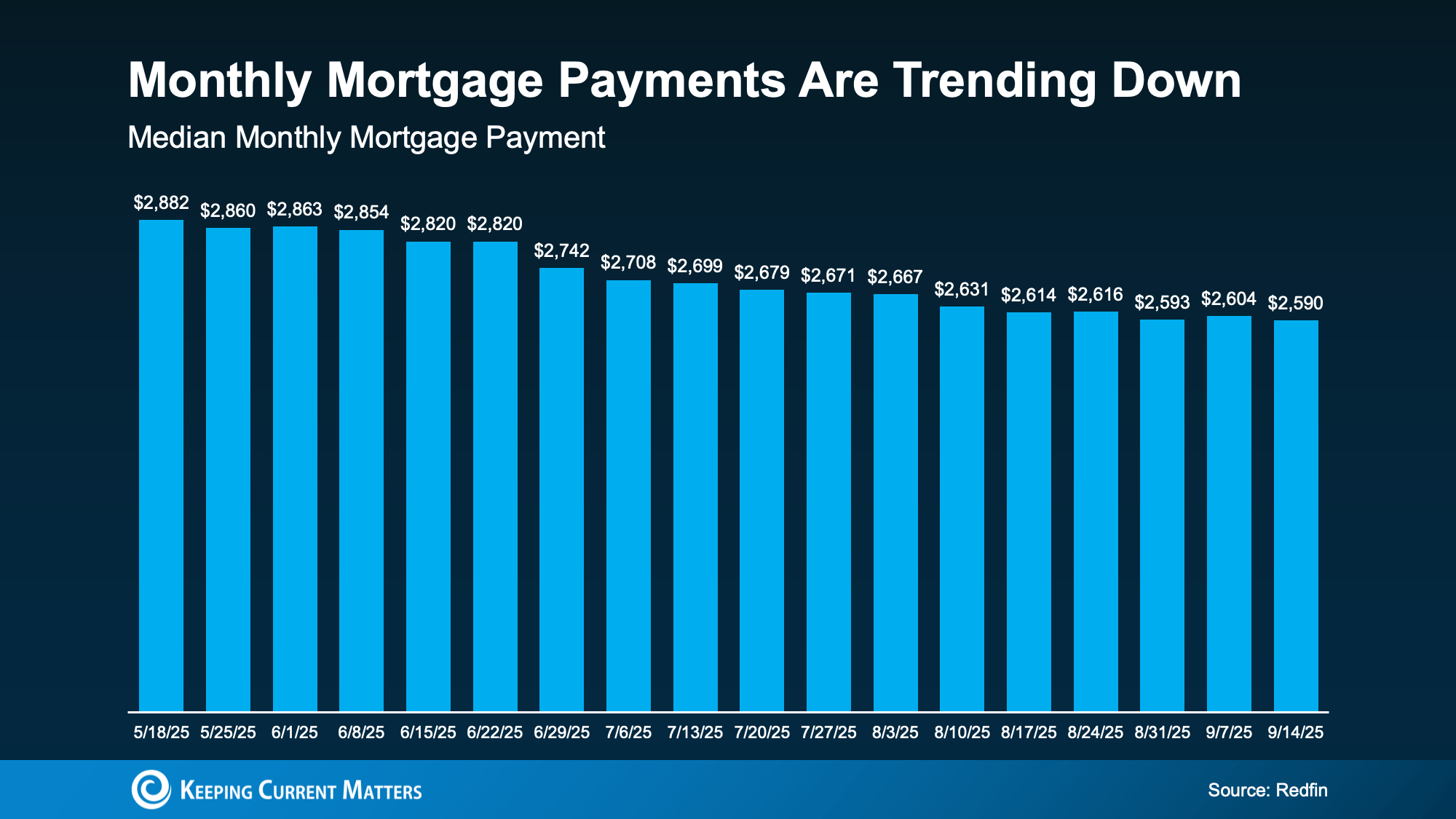

According to Redfin, the typical monthly mortgage payment is now about $290 lower than it was just a few months ago. That’s not pocket change—that’s dinner out, a grocery run, or hey, a streaming service or three.

Here’s what’s shifting in your favor:

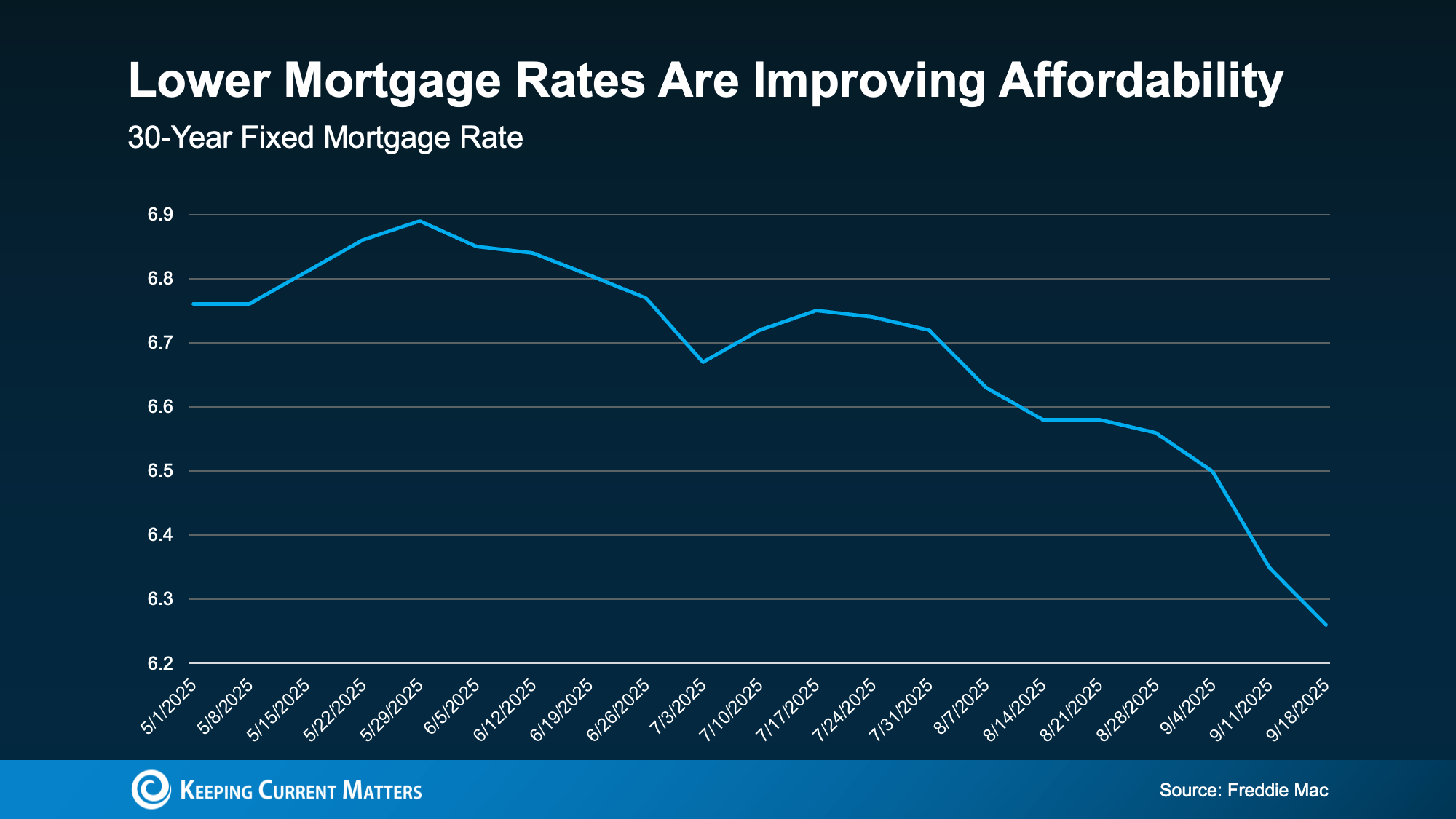

1. Mortgage Rates Are (Finally) Playing Nice 🎉

Back in May, rates were hanging out at around 7%. Today? Closer to 6.3%. Doesn’t sound like much? Think again.

On a $400K mortgage, that tiny dip means about $190 less in monthly payments—just from rates alone. Enough to make some buyers jump back in.

In fact, Joel Kan from the Mortgage Bankers Association said that falling rates just triggered the strongest week of buyer demand since 2022. Translation: buyers are noticing the savings.

2. Home Prices Hit the Brakes 🏡

After years of zooming up like a roller coaster, home prices are finally slowing down to, well… walking speed.

Economist Odeta Kushi explains it best: home price growth is now in the “low single digits.” In some markets, prices have even dipped slightly. That’s a sigh of relief for buyers trying to actually plan a budget without needing three calculators and a crystal ball.

3. Paychecks Are Pulling Their Weight 💵

Here’s the good news from the Bureau of Labor Statistics: wages are up around 4% annually. And Lawrence Yun, NAR’s chief economist, points out that wages are now outpacing home price growth.

That means your paycheck is stretching a little further than it did before—always a win when it comes to tackling big expenses like housing.

What This All Means for You

The “Big 3”—mortgage rates, home prices, and wages—are finally moving in a better direction at the same time. That doesn’t mean buying a home is suddenly easy-breezy. But it does mean it’s not quite as punishing as it was a few months back.

And with mortgage payments already averaging $290 less than earlier this year, the shift could be just enough to make your dream home feel possible again.

Bottom Line

If you’ve been sitting on the sidelines, this fall could be your chance to hop back in the game. Work with a pro to re-run the numbers—you might be surprised at what’s now within reach.

Because sometimes, the right time to buy isn’t when the market is “perfect.” It’s when the numbers start playing a little more nicely with your budget. And right now, that’s exactly what’s happening. ✨