karen@mail.karencynowa.com

Blog

Don’t Let the Headlines Fool You: Foreclosures Aren’t What They Seem

Foreclosure Filings Remain Well Below Crash-Era Levels

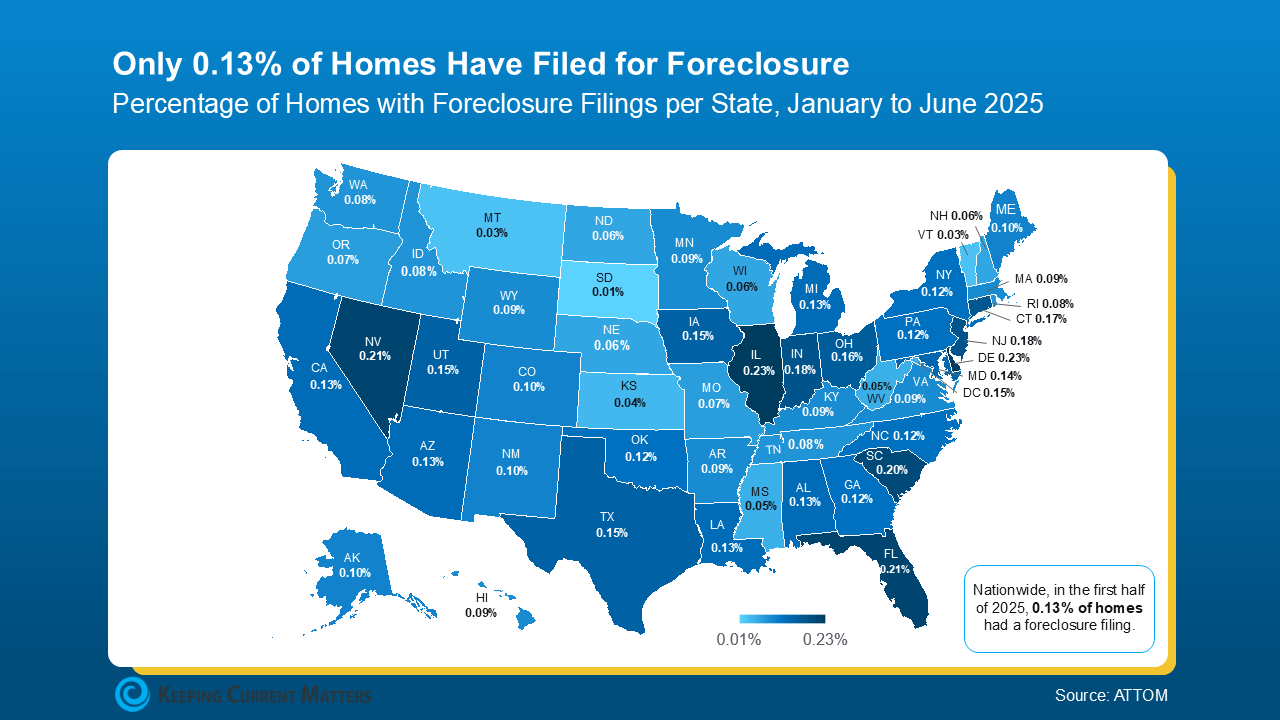

Despite a recent uptick in activity, foreclosure filings remain historically low. In the first half of 2025, just 0.13% of U.S. homes had a foreclosure filing—that’s well under 1%, and even less than a quarter of a percent. In other words, it's a very small fraction of the total housing market.

Still, like most real estate trends, foreclosure rates can vary significantly from one local market to another.

Check out the map below to see how your area compares—and why the numbers aren’t as alarming as headlines might suggest.

Foreclosures Are Still Well Below Crash-Era Levels

To put things into perspective, data from ATTOM shows that in the first half of 2025, 1 in every 758 homes nationwide had a foreclosure filing—that’s the 0.13% shown on the map above.

Compare that to 2010, at the height of the housing crash, when Mortgage News Daily reported 1 in every 45 homes was in foreclosure. That’s a dramatic difference—and a clear sign that today’s market is not heading down the same path.

Today’s Numbers Don’t Signal Trouble

It’s understandable why people get nervous when they hear about foreclosures. Here’s what many remember from the past:

Leading up to the 2008 crash, risky lending practices left many homeowners with unaffordable mortgage payments. As home values dropped, these borrowers found themselves underwater—owing more on their mortgages than their homes were worth. With no equity and no options, many were forced into foreclosure. The result was a massive surge in defaults and a full-blown housing crisis.

But today’s housing landscape looks very different:

Lending standards are much tighter, meaning buyers are more qualified.

Homeowners have near-record levels of equity, thanks to years of rising home prices.

Equity gives people options—even if they fall on hard times, many can sell their home instead of facing foreclosure.

As Rick Sharga, Founder of CJ Patrick Company, explains:

“. . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

No one wants to see a homeowner in distress. But the reality is, if you're facing financial hardship, there may be more solutions available than you realize. It's always a good idea to speak with your mortgage provider early—they can walk you through potential options.

Bottom Line

The headlines may sound concerning, but the numbers tell a very different story. Foreclosure activity remains historically low and is not a sign of an impending crash.

If you're trying to make sense of the market or wondering what all of this means for your home’s value, the best move is to connect with a real estate professional. They’ll help you separate fear from facts and provide insight tailored to your local market.